23 March 2020 | Technical

This outline sets out the main measures enacted and is not exhaustive. We would be very pleased to assist should you have any specific query.

GENERAL TERMS:

The Covid 19 period covers the period from 23 March 2020 to 1 June 2020. However, the period may be extended to any other date prescribed by way of regulations.

REAL ESTATE MEASURES

- The non-payment of rent for commercial and residential leases for the months of March to August 2020 does not constitute a breach of a tenancy agreement provided the rent is paid in full by 31 December 2021.

2) Land and Duties Taxes

- Payment of duty or tax

If the 28-day period to pay duty or tax falls within the COVID-19 period or 21 days after the end of the COVID-19 period, the deadline will be extended to 28 days and 49 days after the end of the COVID-19 period respectively.

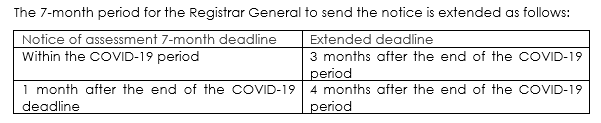

- Notice of assessment

If a notice of assessment falls within the COVID-19 period or within 1 month of the end of the COVID-19 period, the Registrar General will have an additional 3 months after the end of the COVID-19 period to send the notice.

EMPLOYMENT MEASURES

- A worker may be required to work from home provided a notice of at least 48 hours is given by the employer.

- An employer may ask a worker to work on flexitime. A worker may also request to work on flexitime regardless of the reasons.

2) Annual leave deduction

- Employers can deduct up to 15 days of annual leave from the total leave aggregated between 1 January 2020 to the end of the COVID-19 period during the 18 months following the expiry of the Covid-19 i.e. between June 2020 and November 2021. If a worker was working in the period between 23 March and 1 June, no annual leave deduction is applicable.

3) Reduction of workforce

- Employers operating in specified sectors that require a minimum service (e.g. air traffic control, civil aviation, hotel services, transport of passengers and goods) may be able to use an express process if they need to reduce their workforce by applying to the Remuneration Board without need to notify the employee. If the Board finds that the employer’s grounds are justified, the payment of severance allowance of 3 months’ remuneration per year of service may be restricted to 30 days’ wages as indemnity in lieu of notice. The Board may also allow that in lieu of termination of the employment and with the consent of the worker, the worker shall proceed on leave without pay for a specified period and the resumption of employment may be on new terms and conditions.

4) Other employment measures

- No allowance will be paid for work performed on night shift from 16 May 2020 until further notice.

- Workers in the construction and manufacturing industries governed by the Factory Employees (Remuneration) Regulations 2019 will be entitled to compensation during the COVID-19 period under prescribed rates.

OTHER GENERAL MEASURES

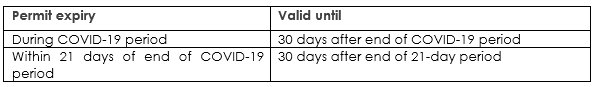

Permits issued under Immigration Act that expired during the Covid-19 period or 21 days after the Covid-19 period is extended for a further period of 30 days after the Covid -19 period lapses.

2) Continuing Professional Development (“CPD”)

Individuals required to undertake CPD courses for continued registration to carry out their professions will be exempt from the requirement during the current year.

Appendix 1