21 September 2019 | Technical

What is the Multilateral Convention to Implement Tax Treaty Related Measures to prevent Base Erosion and Profit Shifting (“Multilateral Instrument” or “MLI”)?

The abuse of tax treaties is one of the focal sources of tax erosion. In order to counteract “treaty shopping”, Action 15 of the BEPS Action Plan recommended the development of an MLI with the aim of incorporating measures to existing bilateral tax treaties to combat tax erosion and profit shifting.

How does it work?

One of the important features of the MLI is that it allows the amendment of bilateral tax treaties without the need to conduct renegotiations between the two countries involved as long as they are both party to the overall MLI agreement.

The MLI covers measures to combat treaty abuse regarding matters such as dual residence, a limitation of benefit clause and an anti-abuse rule for permanent establishments.

Is Mauritius a signatory of the MLI?

Mauritius signed the MLI on 5 July 2017 and deposited its instrument of ratification of the MLI on 18 October 2019.

Mauritius elected to apply the MLI apply to 44 of its 46 tax treaties. The tax treaties with Australia and India do not form part of the MLI.

In order for the MLI to apply, the corresponding jurisdiction of the treaty must also have signed and ratified the MLI and elected for the MLI to apply to their tax treaty with Mauritius. The treaties that Mauritius elected to be covered by the MLI are known as the Covered Tax Agreements (“CTA”).

What treaties does it cover and when does it apply?

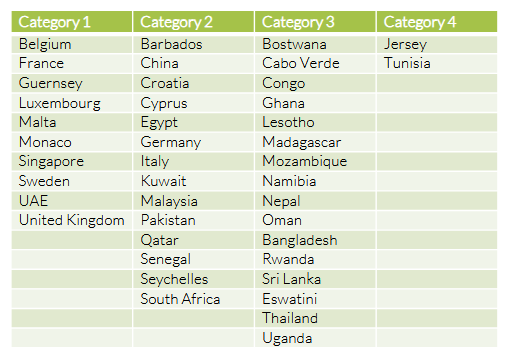

The CTAs can be classified in 4 categories:

The jurisdictions in

Category 1 have already deposited their instrument of ratification, acceptance or approval and the CTA will apply from 1 February 2020.

Category 2 countries are signatories to the MLI but have not yet deposited their instruments. The CTA will apply from the beginning of the 3 months after they sign their instrument.

Category 3 countries have been designated by Mauritius but are not signatories to the MLI. Eswatini (previously Swaziland) has expressed its intent to sign the Convention. The CTAs will therefore only apply once the countries sign the MLI and ratify their instruments.

Category 4 jurisdictions have not chosen Mauritius for the application of the MLI. The CTA will thus not apply to the double tax agreements with these countries.

The MLI provides the framework for amending a double tax agreement. The CTA will either replace an existing provision, change the application of an existing provision or add a provision to the existing double tax agreement, subject to both contracting jurisdictions agreeing.

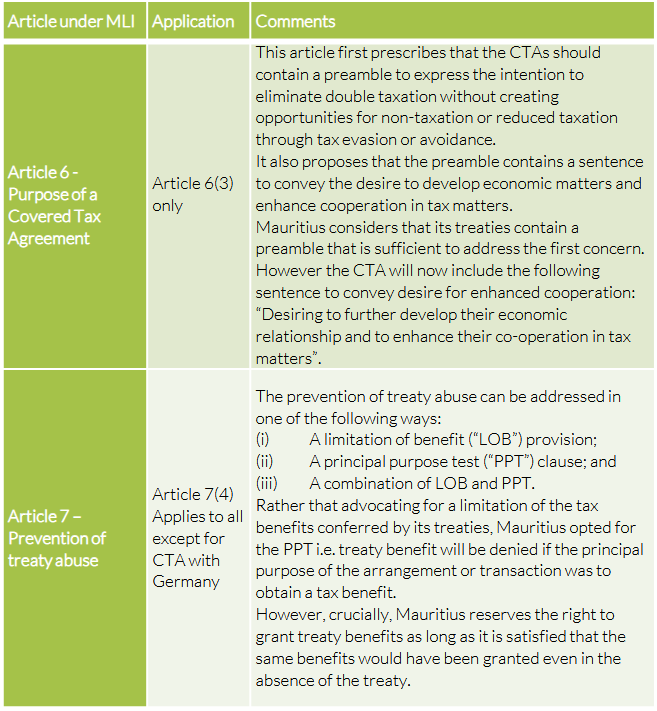

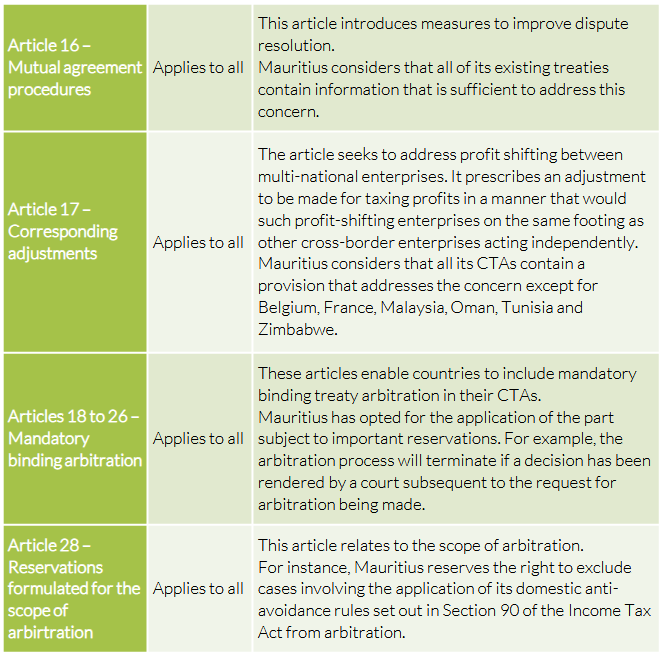

However, each contracting jurisdiction reserves the right for the provisions not to apply to its articles. Accordingly, we set out in the table below the articles whereby the Mauritian government commented on either to amend the treaty or to confirm that the recommendation in the article is already contained in the treaty provision:

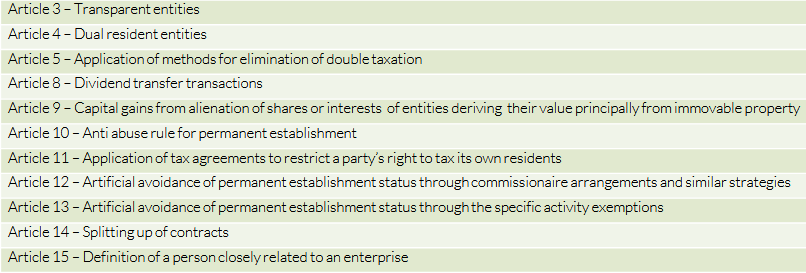

As mentioned previously, Mauritius has commented on all the articles but has elected to apply only the above. For completeness, we set out in the table below the other articles which Mauritius has reserved its right not to apply:

Conclusion

It is an undeniable fact that one of the major attractions of Mauritius as a financial centre is its number of successfully negotiated tax treaties, especially across Africa. It is also clear that the government’s adherence to the MLI shows continued commitment on its part for Mauritius to be viewed as a fiscally respectable country.

Whilst this is a positive step towards tax transparency and stopping the abuse of tax treaties, one does have cause to wonder when one reads the explanatory statement of the OECD, how far Mauritius and other lower tax jurisdictions will have to go to satisfy the requirements of higher tax jurisdictions? After all, Article 6 recommended that the preamble specify that the CTA should not “create opportunities for non-taxation or reduced taxation through tax evasion or avoidance.” Whilst one can agree that artificially created opportunities for tax avoidance is morally repugnant, one cannot help the tinge of uneasiness of it being proposed to be dealt with in the same manner as tax evasion. We all wish for a fairer global tax system but one would hope that we remain the guardians of our morality.